Key Highlights:

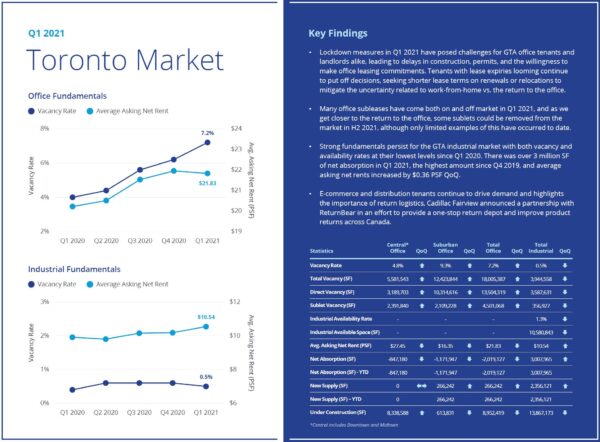

• Q1 2021 brought both the vaccine rollout but also renewed lockdowns, however, this time around many businesses knew how to respond, resulting in minimal job losses. Although sublet space remains an issue, the flood of space coming to the market has slowed, and some believe as 2021 progresses, and employees start returning to the office, we will start to see more sublet offerings being removed from the market.

• Despite both downtown and suburban office rents decreasing, the overall average continued to increase due to the larger proportion of higher-priced downtown space. However, asking rents have not decreased as much as expected, as landlords prefer to make concessions on shorter lease terms, free rent and other TIs. Office tenants facing renewals are asking for shorter terms in order to mitigate the uncertainty related to work-from-home vs. the return to the office.

• The industrial market continues to experience demand from all sectors, resulting in strong positive absorption this quarter, continued vacancy compression, and upward pressure on rents. Industrial development activity has increased as well, however, it will unlikely be able to keep pace with demand, resulting in a chronic shortfall of industrial space. As such, development proformas include strong rent growth expectations, which is ultimately further driving up land prices.